BULLSEYE: Doocy Calls Out Biden WH Deception on Defining a Recession

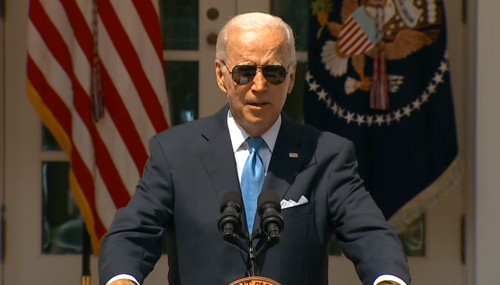

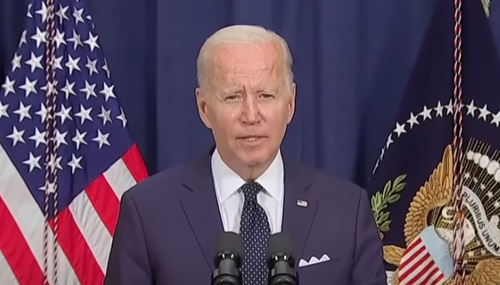

Wednesday’s White House press briefing wasn’t smooth sailing for Press Secretary Karine Jean-Pierre (as most if not all are for someone in way over their head) with Fox’s Peter Doocy and a select few others reporters who pressed her on the Biden administration’s disinformation campaign to redefine what a recession is ahead of what’s expected to be a dour second quarter number on Thursday.

Liberal Pravda Machine Helps Shield Biden on ‘Recession’

The liberal media machine is kicking into overdrive to convince the American people not to believe their lying eyes on the economy. Don’t worry if the second-quarter GDP numbers are atrocious, the narrative goes. It doesn’t necessarily mean we’re in a recession.

As Biden Economy Gets 'Complicated,' Ruhle Trashes Trump Economy

After spending Monday praising the Biden economy as the country barrels towards a possible recession, MSNBC’s Stephanie Ruhle used Tuesday’s The 11th Hour to say to conservatives that miss the Trump economy, that things were not that good under the prior administration, even without the pandemic.

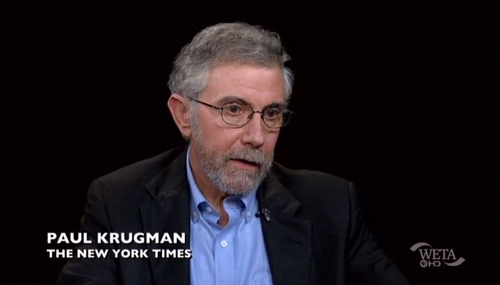

Krugman Begs Readers to ‘Ignore’ Two-Quarter Recession Rule for Biden

The New York Times economics columnist Paul Krugman went from admitting he completely botched his “transitory” inflation calls to gaslighting readers over the possibility of a recession.

Washington Post Writer Tries to Redefine ‘Recession’

In a conversation on Monday’s CNN Newsroom with host Ana Cabrera, Washington Post Opinion columnist Catherine Rampell refused to look at inflation or recession in a bad light. In fact, they refused to even admit we were possibly in a recession, according to the official definition it holds.

Did WH Take Its Recession Spin Cues from a Soros-Funded Outlet?

The White House attempted to gaslight Americans by casting confusion over the meaning of a recession. But did it take its cues from a major publication funded by liberal billionaire George Soros?

ABC, NBC Let Biden Slide on Redefining Recession, CBS Skips

On Sunday, Fox News White House correspondent Jacqui Heinrich took to Twitter to note how the Biden administration and the Council of Economic Advisers are seeking to redefine what a recession is. In reality, a recession is defined by two consecutive quarters of negative economic growth. Concerned that this week’s GDP report will show the second straight quarter of negative growth, the White…

Biden Admin Tries To Redefine Recession; Media Accidentally Ruin it

For years, journalists and experts alike have argued in favor of the definition which the Biden administration has just tried to undo: that at least two straight quarters of negative GDP growth means the country is in a recession.

‘I Was Wrong’: Krugman Kicks Himself for Awful Inflation Takes

The New York Times opinion section actually published a shocking project where eight of their columnists admitted they were wrong about either economics, tech, foreign affairs or politics. At the top of the list was none other than “transitory” inflation gaslighter Paul Krugman.

NYT Mag Interview Whines Over America’s Economic Growth 'Obsession'

The New York Times Magazine is getting in front of estimates that the U.S. GDP contracted again in the second quarter by slamming the country’s “obsession” with economic growth.

Kristol Tweets Dumb Inflation Take Minutes Before Awful Inflation News

Insufferable NeverTrumper Bill Kristol should know by now that putting dumb inflation hot takes on Twitter minutes before devastating economic news is released doesn’t return dividends.

INSANE: CNN Argued Recession Proclamations Are Racist

CNN attempted to fool Americans into believing the reason the U.S. economy isn’t officially considered in a recession is because eight “white economists” didn’t say so yet. Confusingly, CNN also wrote that if leading economists do end up eventually declaring the U.S. to be in recession, it’s also because those economists aren’t racially sensitive.

FLASHBACK: Reich Once Claimed Biden $1.9T Stimulus Wasn’t Inflationary

Clinton stooge Robert Reich has just as much of a sordid record in his coverage on the inflation crisis as leftist economist Paul Krugman.

PAINFUL: Paul Krugman Admits He ‘Badly Underestimated Inflation Risks’

New York Times economics columnist Paul Krugman made another damning admission this past week about his sordid record analyzing economics as inflation continues to bite chunks out of Americans’ wallets.