'Billions' Pushes Agenda that Success and Debauchery Go Hand in Hand

Culture

February 20th, 2017 12:00 PM

The second episode of this season of Showtime’s Billions, which aired February 19, illumines the left’s belief that any sort of success must be associated with moral indecency. The show revolves around the power politics between billionaire hedge-fund manager Bobby Axelrod (Damian Lewis) and U.S. Attorney Chuck Rhodes (Paul Giammati).

Video

'Billions' Pushes Agenda That Success and Debauchery Go Hand in Hand

Culture

February 20th, 2017 12:58 AM

The premiere of the second season of Showtime’s Billions, which aired February 19, illumines the left’s belief that any sort of success must be associated with moral indecency. The show revolves around the power politics between billionaire hedge-fund manager Bobby Axelrod (Damian Lewis) and U.S. Attorney Chuck Rhodes (Paul Giammati).

Video

CNBC’s Santelli: People Want to ‘Put Cold Water’ on Trump Rally

Business

February 17th, 2017 3:11 PM

Rather than rejoice over the stock market rally, many people are pushing economic pessimism and that upset CNBC’s Rick Santelli. The CNBC editor and contributor complained about the pessimism on Squawk Box Feb. 16. “Much of the world always finds something to cheer about, always finds hope in every stock market. This particular rally, because of the president, everybody wants to put cold water on…

Washington Post Columnist Compares U.S. Stock Rally to 'Nazi Germany'

Business

January 25th, 2017 6:01 PM

Washington Post columnist Anne Applebaum compared the recent surge in the stock market to … you guessed it… Nazi Germany. On Jan. 25, 2017, she tweeted to keep in mind that “in Nazi Germany, the stock market rose and rose and kept rising, right up to Stalingrad.”

Stocks Reach 16 Records, Nets Only Credit Trump 6 Times

Business

December 19th, 2016 11:14 AM

As the Dow Jones Industrial Average neared the 20,000 mark for the first time in history, the index set 16 closing-day record highs since Donald Trump’s election. Even some liberal media outlets have drawn a direct connection between the soaring stock market and Trump’s election, going so far as to label it a “Trump stock market rally.” But the broadcast networks often ignored any connection,…

Nets Ignore Business Attacks on Trump, Supporters After Election

Business

November 23rd, 2016 10:20 AM

After Donald Trump’s victory Nov. 8, several business leaders freaked. The post-election response even included a CEO’s threat on Trump’s life, but none of the major broadcast evening news shows picked up the hysteria. Business leaders despaired, told employees to resign for disagreeing with their virulently anti-Trump views and warned of “extremely dangerous times.” But threatening violence and…

Paul Krugman, As Trump Wins: Markets Will 'Never' Recover

November 10th, 2016 11:41 PM

Wednesday morning at 12:42 a.m., as it was becoming clear that Republican presidential nominee Donald Trump was on the verge of officially defeating Democrat Hillary Clinton for the presidency, Paul Krugman at the New York Times noted at the paper's election night live blog that the "markets are plunging." He then wrote: "If the question is when markets will recover, a first-pass answer is never…

Video

Media Warn Trump Win Bruises Stocks, Day Before Dow's ‘Record High'

Business

November 9th, 2016 4:57 PM

The liberal media were in mourning on Election Night when it became clear Donald Trump would be the next president of the United States. Panic was palpable and journalists, particularly on NBC networks, blamed a significant drop in Dow futures on Trump’s victory. CBS said the drop in futures felt like “Brexit,” while Rachel Maddow claimed Trump would wear the market drop as a “badge of honor.”…

Video

NBC Demands Trump ‘Rectify’ ‘Economic Collapse’ Caused By His Victory

November 9th, 2016 4:23 AM

Minutes after President-Elect Donald Trump concluded his victory speech that ended on Wednesday around 3:00 a.m. Eastern, the cast of characters immediately demanded that Trump seek to “rectify” the tumbling stock market that could lead to an “economic collapse” similar to what Barack Obama inherited when he was inaugurated in 2009.

Video

Press Yawns, Santelli Goes Off as Fed Wants to Be Able Buy Stocks

September 30th, 2016 10:17 PM

On Thursday, Federal Reserve Chairman Janet Yellen suggested in a videoconference call, as translated into plain English by the Wall Street Journal, that "there could be benefits to allowing the central bank to buy stocks as a way to boost the economy in a downturn."

Video

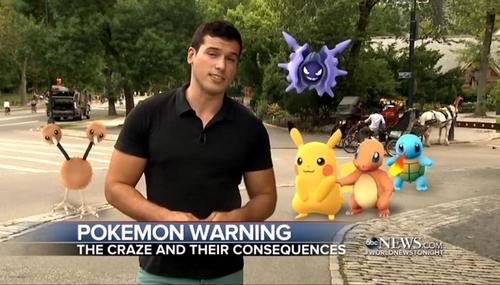

Monster Bias: Networks Spend 2X More Time on Pokemon Go than Economy

Business

August 11th, 2016 4:06 PM

When it came to covering issues voters cared about, the networks didn’t catch ‘em all, especially the most important one. According to the Pew Research Center, voters ranked the economy as their highest priority in July. But the media had different priorities in its coverage. It spent twice as much time reporting on Pokemon Go, a mobile game in which players caught cartoon monsters, than it did…

Video

5x Networks Hyped the Brexit ‘Meltdown’ Before the Market Rebounded

Business

July 15th, 2016 2:10 PM

The media exuded panic surrounding the vote for the U.K. to leave the European Union, commonly called Brexit. Reports after the vote panicked over how much markets had fallen, worried about a potential recession for the UK and otherwise attacked the outcome.

Video

Hillary 'Wall Street $peeches' Clinton Promises Non-Rigged Economy

June 22nd, 2016 8:08 AM

The establishment press must not think that anyone should care about the millions of dollars Bill Clinton and his wife Hillary have "earned" making speeches, particularly to powerful banks and Wall Street firms, since he left the presidency in 2001 and after her time as Secretary of State ended in 2013.

That's the only explanation as to why Mrs. Clinton could promise, as she did on Tuesday, that…

Video

NBC Touts Movie’s ‘Message for Wall Street,’ ‘Sympathy’ for Terrorist

May 13th, 2016 2:40 PM

During an interview with the stars of the Hollywood’s latest anti-capitalist screed, Money Monster, on Friday’s NBC Today, correspondent Keir Simmons summed up the plot of the film: “In the movie, [George] Clooney is forced to wear an explosive vest by British rising star Jack O'Connell. Who lost his dead mother's money on stocks.” Simmons noted: “This guy is a terrorist, who you end up feeling…