After pulling an all-nighter bickering, the House Ways and Means Committee passed a tax package Wednesday morning that it says will save the average American family enough money to pay for more than two months of groceries.

In a 29-16 vote cast strictly along party lines, Republicans passed the committee’s contribution to their reconciliation bill, including provisions to extend, expand and make permanent the tax cuts instituted in 2017 during the first Trump Administration.

“We’re delivering President Trump’s promises to allow the economy to flourish,” House Speaker Mike Johnson (R-La.) announced following the vote, touting some of the new taxpayer benefits included in the package:

- No taxes on tips.

- No taxes on overtime.

- No taxes on loan interest for American-made cars.

- Tax relief for seniors.

However, it’s not just how much money Americans will save if the Trump tax cuts are extended – it’s how much money they stand to lose, if they aren’t.

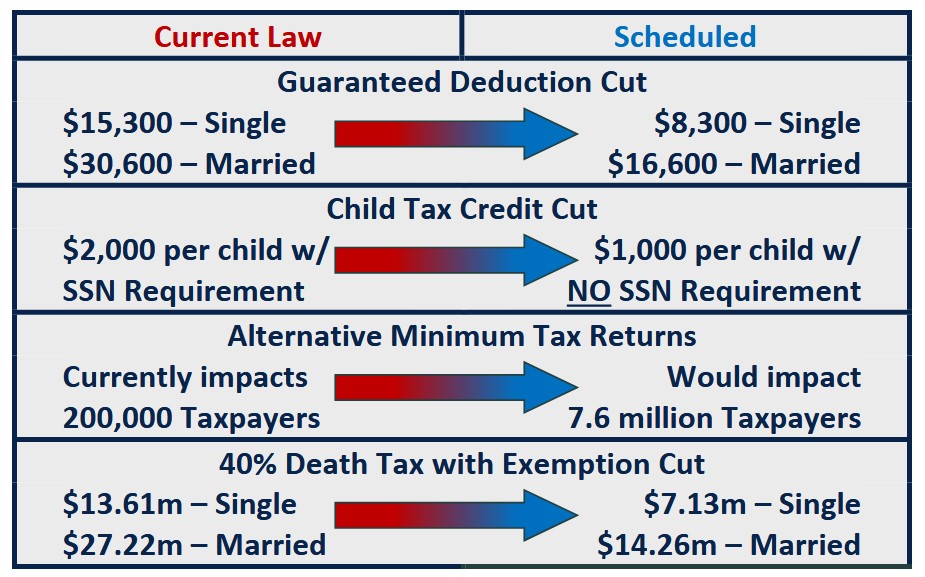

In an overview posted online, the Committee details the cost to taxpayers if the Trump tax cuts are allowed to expire, including:

- The average taxpayer would see a 22% tax hike if the Trump tax cuts expire.

- A family of four making $80,610, the median income in the United States, would see a $1,695 tax increase if the Trump Tax Cuts expire.

- The $1,695 lost would cost the average family the equivalent of the price of more than two months (9 weeks) of groceries.

- 90% of all taxpayers would see their guaranteed tax deduction cut in half.

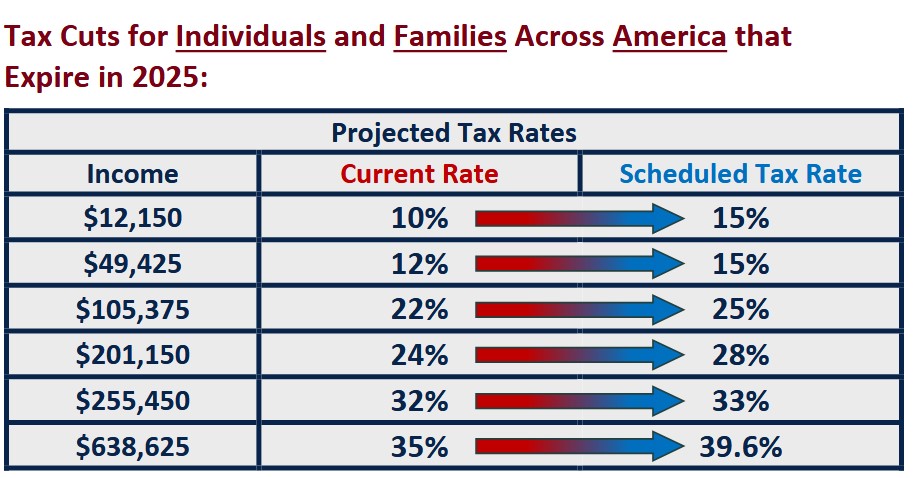

The report includes a chart showing how the tax rates will increase for every income group above $12,150.

And, as The Washington Examiner explains, expiration of Trump’s Tax Cuts and Jobs Act (TCJA) would especially hurt low-income earners by taking away the TCJA’s increase in tax-free income:

“To start at the bottom of the income ladder, the TCJA increased the ‘zero-percent’ tax bracket by nearly doubling the standard deduction from $6,350 to $12,000 while eliminating the personal exemption of $4,050. That meant the average single, unmarried taxpayer received their first $12,000 tax-free compared to $10,400 before the law.”

…

“TCJA made it clear that the lowest 20% of earners would not pay federal income taxes.”