A billionaire and a receptionist walk into an IRS bar. They each order a beer. The IRS bartender charges the receptionist $2.50 and the billionaire $2,260. Who got undercharged? If you're Warren Buffett or Tom Brokaw, the answer is . . . the billionaire.

A billionaire and a receptionist walk into an IRS bar. They each order a beer. The IRS bartender charges the receptionist $2.50 and the billionaire $2,260. Who got undercharged? If you're Warren Buffett or Tom Brokaw, the answer is . . . the billionaire.As NB Editor Brent Baker has noted, the NBC Nightly News "decided Monday night to base a story on a four-year-old contention by a professor that the middle class is worse off now than in the 1970s, followed by a piece promoting Warren Buffett's claim the rich don't pay enough in taxes."

NBC was back at it again this morning, with a "Today" segment featuring Brokaw's interview with Buffett and his gripe that the rich are undertaxed. Brokaw seconded Buffett's notion, introducing the segment this way:

When you're the world's third-richest man, you can break some rules. Warren Buffett, the "Oracle of Omaha," is going after a fundamental injustice he says touches all Americans [cut to clip of Buffett]: the taxation system has tilted toward the rich and away from the middle class in the last 10 years. It's dramatic and I don't think it's appreciated."

Let's deconstruct Brokaw's statement. Brokaw wasn't quoting Buffett in describing allegedly too-low taxes on the rich as a "fundamental injustice." Those were Brokaw's own words, his personal characterization of the situation.

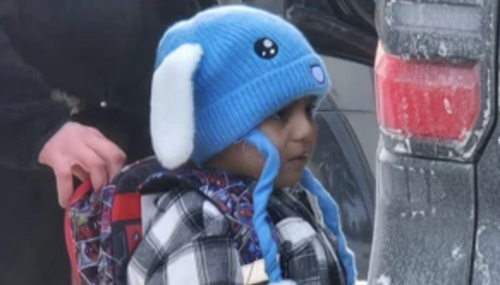

In the course of the interview, Buffett mentioned that his effective tax rate last year was 17.7%, whereas an informal survey he conducted of his office workers showed they paid an average of 32.9%. Brokaw was seen [screencap] in Buffett's office , telling [taunting?] the receptionist: "You know, at the end of this year, you're going to pay a higher tax rate -- percentage of your income -- than this guy [pointing to Buffett]."

Of course Brokaw focused only on the rate the various people paid, rather than amount they actually paid in taxes. I poked around and found this site, which indicates that Buffett's 17.7% was paid on income of $46 million. That would mean that Buffett paid $8,142,000 in taxes.

The site states that the receptionist paid 30%. Her income wasn't given, but let's estimate her earnings at $30,000. That would mean that she paid $9,000 in taxes, equal to 1/904th of what Buffett coughed up. That's in line with the indication from NewsBuster Tom Blumer that in a recent year, the wealthiest 1% paid 35% of all federal taxes.

Note also that, Buffett's tax break, as indicated in the segment, stems largely from the fact that much of his income comes from capital gains, which are taxed at a lower rate. Does Brokaw want to increase capital gains to 30% or more? What would be the impact on the U.S. economy? How many of those receptionist jobs would disappear?

Another fact that was glossed over: the calculation was made on the combined payments of both federal income taxes and "payroll taxes," which includes Social Security. The maximum taxable income for Social Security is $97,500. Some liberals, such as those at the Economic Policy Institute [see proposal #4], have proposed eliminating the cap. That would mean that all of Buffett's $46 million would be taxable. He wouldn't of course receive any more in benefits as a result. This would transform Social Security into a welfare program. Is that what Brokaw backs?

When it comes to fixing this "fundamental injustice," Brokaw isn't just a reporter. He's an avid volunteer in Buffett's Progressive Army.

Update | 10-31: Reader ECS passes along this article, containing an analysis casting into doubt the claim that the receptionist is paying 30% of her salary in taxes.