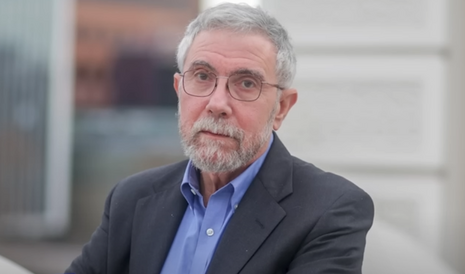

The New York Times economics columnist Paul Krugman’s so-called “rules” for Bidenomics that he preached just days before President Joe Biden took office aged like spoiled milk.

Krugman published a blog six days before Biden’s inauguration where he established “Rules That Should Guide Bidenomics.” Among Krugman’s garbage heap of ideas, he argued that Biden shouldn’t worry about national debt or inflation and should spend taxpayer monies like a madman. He summed up his trainwreck of suggestions for Biden: “damn the torpedoes, full speed ahead.”

Krugman published a blog six days before Biden’s inauguration where he established “Rules That Should Guide Bidenomics.” Among Krugman’s garbage heap of ideas, he argued that Biden shouldn’t worry about national debt or inflation and should spend taxpayer monies like a madman. He summed up his trainwreck of suggestions for Biden: “damn the torpedoes, full speed ahead.”

How brilliant! Just over a year into the Biden presidency, the American economy is now reeling from a 40-year high inflation crisis, an energy crisis, a debt crisis, a housing recession, supply chain disruptions and more. But in January 2021, Krugman was confident that his “rules, based on hard experience,” were the key to American economic success. He also dismissed how “bogus economic concerns” shouldn’t “stand in the way of delivering the” leftist policies Krugman said “America needs.” But history hasn’t treated Krugman well.

Here are three of Krugman’s Bidenomics “rules” from Jan. 14, 2021 that ended up self-destructing.

- “Rule #1: Don’t doubt the power of government to help.” Following Biden’s inflationary “$4.6 trillion” in new spending and The Federal Reserve’s disastrous money printing policies, The Heritage Foundation now estimates that “the average American has lost the equivalent of $4,200 in annual income under the Biden administration because of inflation and higher interest rates.” The money supply, also referred to as M2, skyrocketed to over $21,000,000,000,000 in July, according to the Federal Reserve Bank of St. Louis. Just two years earlier in July 2020, when Donald Trump was president, the money supply was roughly $18 trillion, meaning that the money supply ballooned by over 16 percent in just two years. To quote late President Ronald Reagan, “The nine most terrifying words in the English language are: I'm from the Government, and I'm here to help.”

- “Rule #2: Don’t obsess about debt.” The U.S. National debt soared over $30 trillion after Krugman wrote this. Krugman grumbled against the “[c]onstant warnings about the dangers of government borrowing hobbled the Obama agenda almost from the start. Biden shouldn’t let that happen again.” Now, the Committee for a Responsible Budget estimated on Sept. 13, 2022 that Biden’s excessive government borrowing ($4.8 trillion so far) will “lead to continued inflationary pressures, drive the national debt to a new record as soon as 2030, and triple federal interest payments over the next decade – or even sooner if interest rates go up faster or by more than expected.”

- “Rule #3: Don’t worry about inflation.” Yikes. Krugman had a lot to say at the time about the so-called inflation doom mongers who ended up being right. Krugman slammed the “[c]onstant warnings about soaring prices, combined with false claims that the government was hiding the true rate of inflation,” and snarked that “inflation never took off.” The U.S. Chamber of Commerce released a new survey Sept. 21, 2022 showing that 90 percent of small businesses — a “new high” — are “concerned about the impact of inflation on their business, with 54% saying they are very concerned.” Here’s the telling part: “Half of small businesses (50%) say inflation is the biggest challenge facing small business right now.” CNN released a story Sept. 27, 2022 headlined: “71% of workers say their pay isn’t keeping up with inflation.”

These three awful “rules” that Biden clearly followed viewed alongside Krugman’s July 2022 mea culpa admitting he was “wrong” on inflation make it clear that Krugman should probably return his Nobel prize in economics. In January, Krugman conceded that he didn’t understand “what the hell has been going on” with inflation. He apparently doesn’t know “what the hell” makes for good economic policy either.

Conservatives are under attack. Contact The New York Times at 1 (800) 698-4637 and demand it distance itself from Krugman’s economic nonsense.