Daniel Dale Should Try Fact-Checking His Own Network — For Once!

Hey Daniel Dale! Riddle us this: How in the world do you expect anybody to take you seriously as a fact-checker against President Trump’s supposed “falsehoods” when your own network commits the same offenses?

CNN's Spin on Inflation: 'Falling' for Biden, 'Persistent' for Trump

The internet is forever! At least that’s a concept most people on the internet besides CNN seem to grasp. On Tuesday, CNN made its double standard on inflation so nakedly apparent it needs an NC-17 rating. Inflation under Biden was "falling," but under Trump it's "persistent....as high prices continue to weigh on many Americans."

Pin the Tail on the Jackass: CNBC Blames Biden for Affordability Issue

It’s always great TV when the business journos over at CNBC take a wrecking ball to the media’s never-ending croaking against the Trump administration for an affordability issue they pretended wasn’t such a big deal under its predecessor.

HUH? USA Today Whines Trump Maduro Capture Means He's Ignoring Economy

Apparently, the ignoramuses at USA Today thought it was brilliant strategy to whine that President Trump deposing a narco-terrorist dictator—who runs an oil-rich state and has been flooding America with deadly drugs—somehow means he's ignoring the economy.

CNN Tries Having It Both Ways With Dumbest Trump Economy Griping Yet

Narrative consistency on economic coverage is definitely not one of CNN’s strongest suits, and its latest pile of garbage it spewed to harangue President Donald Trump’s economy is case-in-point.

New York Times Mangles It: 'Trump Calls Affordability a Con Job'

Leave it to The New York Times to try to channel its Fine People Hoax energy to once again twist President Donald Trump’s words to make him seem like a Bond villain who scoffs at the plebeians' struggles against inflation.

HA! CNN’s Anti-Trump ‘We Ain’t Buying It’ Black Friday Push Flopped

Looks like CNN Democrat political commentator Bakari Sellers’ push of a leftist campaign to boycott businesses that supported President Trump in any way fell harder than Kamala’s poll numbers on Election Day.

Holy Cow! WashPost Tells Americans ‘You May Not Want Lower Prices’

Sometimes leftist media outlets try to out-dumb themselves like it’s some sort of prestigious competition for who can churn out the most ignoramus hot take of the year. The Washington Post is definitely in the running for first place with its latest stupidity about inflation.

Axios Admits Trump Economy One of the Better Economies of Modern Times

Axios perhaps just inadvertently committed one of the most based forms of narrative-wrecking journalism ever to hit the leftist media ecosphere by admitting the Trump economy is a lot better than what the propaganda suggests.

CNN Gobsmacked: Trump’s Economy Keeps Defying Doom Coverage

Following the gangbusters’ September jobs report that vastly eclipsed expectations, CNN hacks are now awkwardly doing the Watusi dance to try and explain around why the Trump economy isn’t the disaster they said it was.

OMG! CNN Admits 'Trump Is Right: He Lowered Some of Your Costs'

When CNN actually decides to give President Donald Trump an inch on anything positive about the economy, it’s the equivalent of a seismic earthquake rippling through the entire media landscape.

Oh Look, an Idiot: Krugman Calls Bidenomics Triumph Nobody Appreciated

Pseudo economics savant Paul Krugman just can’t give up trying to sell the snake oil of Bidenomics as being the unsung hero of the economy that the supposedly dumb plebeians just couldn’t appreciate.

CNN Should Zip It on Trump Inflation Lectures After Bidenomics Blunder

Here’s a serious question: Who on God’s green earth made CNN believe it has the credibility to finger-wag at President Donald Trump over inflation after salivating over Bidenomics for four years?

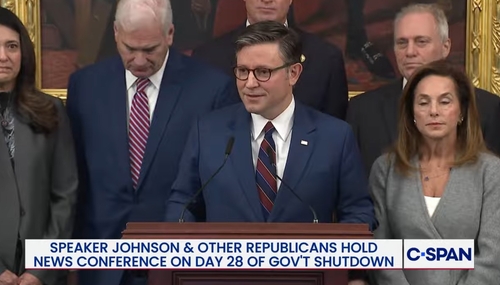

Hill Journos Tweet Twice as Many Johnson Jabs vs Shutdown Consequences

A NewsBusters analysis of five leading liberal Capitol Hill reporters has found that, by a margin of roughly two-and-a-half-to-one (72 to 28), they have taken to X more times since the start of the government shutdown to condemn Speaker Mike Johnson (R-LA) and the House for being out of session than they have highlighted crucial government programs like food stamps and pay for soldiers that…